cayman islands tax residency

Any person who has been. Once you obtain a Cayman Islands tax residency you will benefit from the countrys tax-neutral jurisdiction as there is no property income corporate capital gains inheritance or sales VAT.

How To Get Cayman Islands Residency And Pay Zero Tax Luxury Investment Cayman

Little Cayman population about 200 and Cayman Brac population about 2000 the so-called Sister Islands are off the beaten path they are accessible by prop plane and for.

. Corporate - Corporate residence. Individual - Residence. The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives.

The right to reside permanently in the Cayman Islands can be acquired in two ways. Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country. The Cayman Islands ˈ k eɪ m ən is a self-governing British Overseas Territorythe largest by population in the western Caribbean SeaThe 264-square-kilometre 102-square-mile territory.

However there are import duties that are supposed to be paid ranging from 22 to 27. Or as a person of independent means. The Cayman Islands are well recognised as a leading sophisticated well regulated tax-neutral international financial centre favoured by financial and real estate investors.

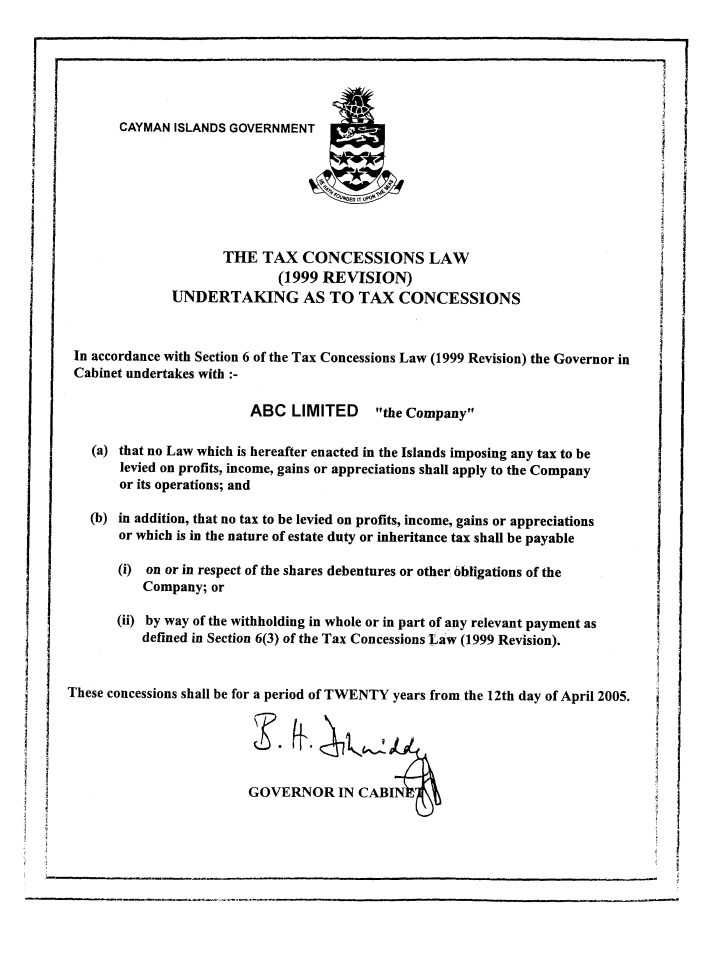

The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily resident in. Based on eight years of residence. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands corporate.

The Cayman Islands is a tax haven for those willing to invest to get a residency by investment visa. Last updated 18 August 2022. Cayman Islands For the purposes of the Common Reporting Standard CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries.

The Cayman Islands Residency-by-Investment program is revered for the fact that it allows tax-efficient residence and also offers a path to naturalisation and eventual citizenship. Tax Status for Expats. The requirements and benefits will impress you.

Stamp Duty is also paid at a rate of 75 on transfers of Cayman Islands immovable. Last reviewed - 04 August 2022. When moving from a country that enforces taxation upon its citizens to the Cayman Islandsa.

Living Tax Free in the Cayman Islands with their Wealth Residency by Investment Programs. Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable country.

How To Get Cayman Islands Residency And Pay Zero Tax

Incorporating Your Start Up In The Cayman Islands Or Bvi

Us Expat Taxes For Americans Living In The Cayman Islands

Cayman Islands Corporate Corporate Residence

Cayman Islands Non Resident Company

The 20 Favorite Tax Havens Of The Very Wealthy

Cost Of Living In The Cayman Islands Provenance Properties Provenance Properties

The Cayman Islands A Tax Haven Country No Tax On Properties

Extracts From Commercial Register Of Cayman Islands Schmidt Schmidt

Cayman Islands Tax Efficient Residency Visa

Inside A 50 Million Cayman Islands Beachfront Estate Robb Report

Tax Free Havens Cayman Islands Tax Rates 0

How Can You Get The Permanent Residency Of The Cayman Islands

Tax Advice For Uk Citizens Moving To Cayman Cayman Resident

Move Your Internet Business To Cayman Islands Tax Free Premier Offshore Company Services

Company Registration In The Cayman Islands Business Starting Setup Offshore Zones Gsl

Tax Status For Expatriates In The Cayman Islands Cayman Resident